UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

|

| | | | | | | | | | |

| Filed by the Registrant | | þ | |

| | | |

| Filed by a Party other than the Registrant |

|

| | | | | | | |

| Check the appropriate box: |

| o | | Preliminary Proxy Statement |

| o | | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| þ | | Definitive Proxy Statement |

| o | | Definitive Additional Materials |

| o | | Soliciting Material Under Rule 14a-12 |

HYSTER-YALE MATERIALS HANDLING, INC.

(Name of Registrant as Specified in Its Charter) |

| | | | | | | | | | |

Payment of Filing Fee (Check the appropriate box)all boxes that apply): |

| þ | | No fee required. |

| o | | | Fee paid previously with preliminary materials. |

| o | | Fee computed on table belowin exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | |

| | (1) | Title of each class of securities to which transaction applies: |

| | | |

| | (2) | Aggregate number of securities to which transaction applies: |

| | | |

| | (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | (4) | Proposed maximum aggregate value of transaction: |

| | | |

| | (5) | Total fee paid: |

| | | |

o | | Fee paid previously with preliminary materials: |

| | | |

| | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| | | |

| | (1) | Amount Previously Paid: |

| | | |

| | (2) | Form, Schedule or Registration Statement No.: |

| | | |

| | (3) | Filing Party: |

| | | |

| | (4) | Date Filed: |

5875 LANDERBROOK DRIVE, SUITE 300

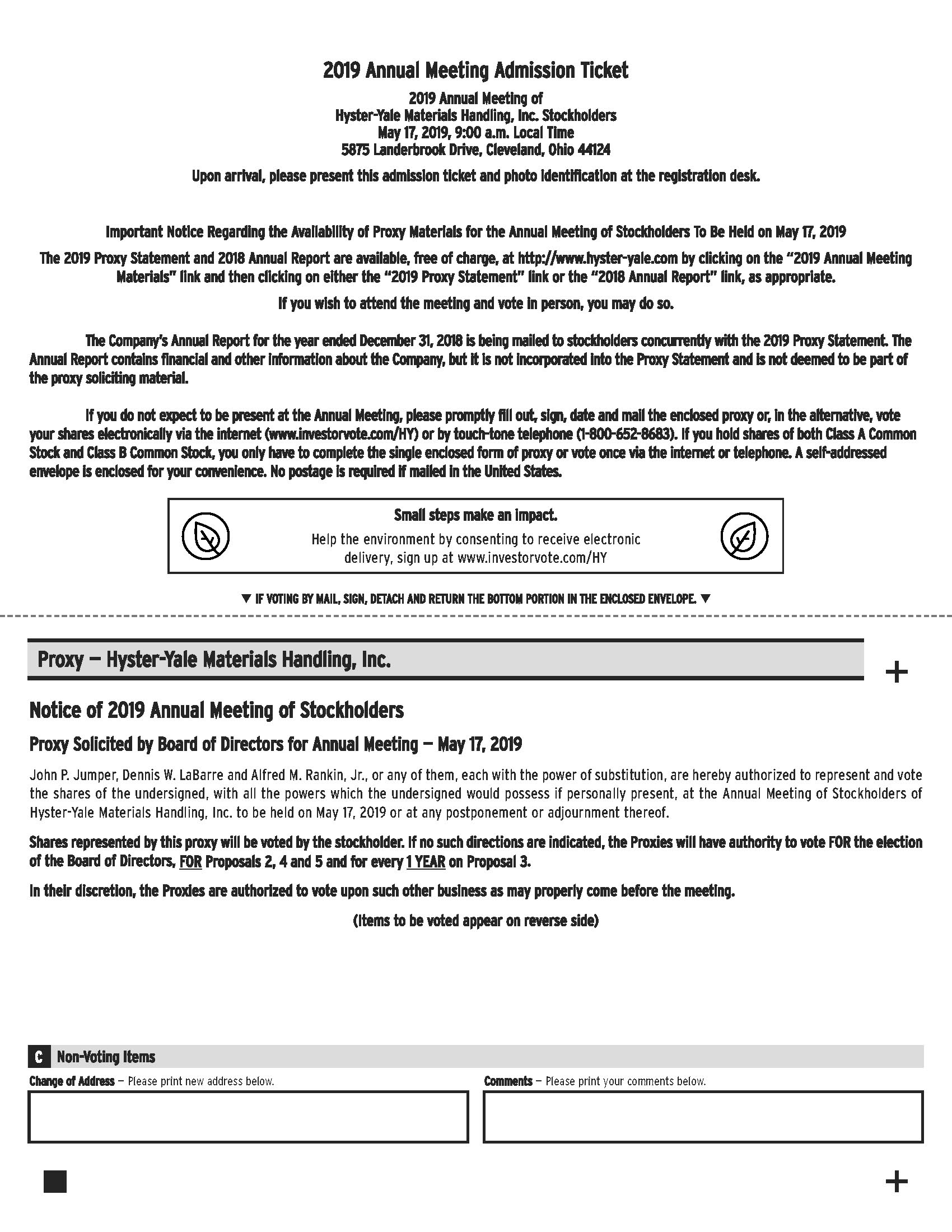

CLEVELAND, OHIO 44124-4069 The Annual Meeting of stockholders of Hyster-Yale Materials Handling, Inc. (the "Company") will be held on Friday,Tuesday, May 17, 201910, 2022 at 9:00 a.m., at 5875 Landerbrook Drive, Cleveland, Ohio, for the following purposes:

| |

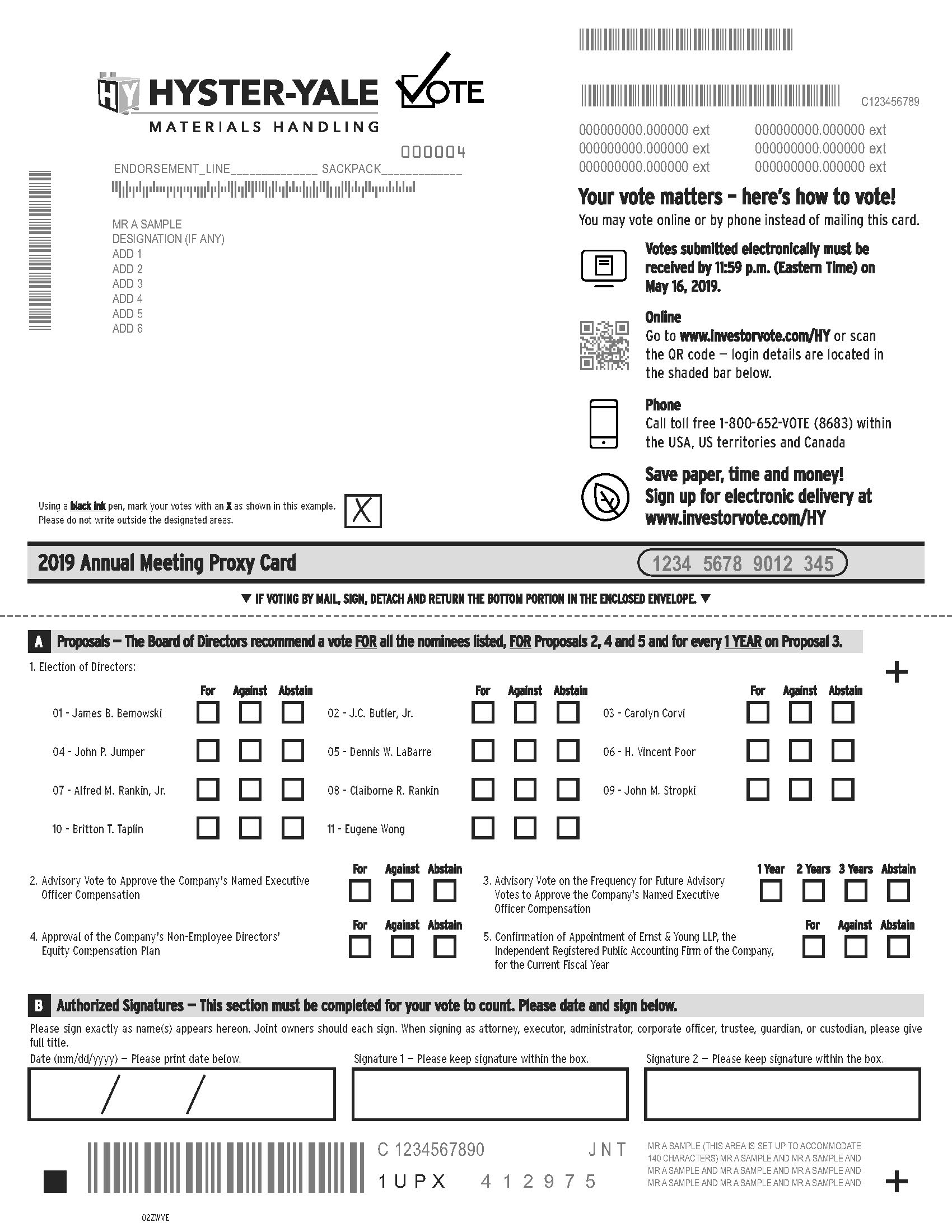

1. | To elect eleven directors for the ensuing year; |

| |

2. | To approve on an advisory basis the Company's Named Executive Officer compensation; |

| |

3. | To vote on an advisory basis on the frequency for future advisory votes to approve the Company's Named Executive Officer compensation; |

| |

4. | To approve the Company's Non-Employee Directors' Equity Compensation Plan; |

| |

5. | To confirm the appointment of Ernst & Young LLP, as the independent registered public accounting firm of the Company, for the current fiscal year; and |

| |

6. | To conduct any other business as may properly come before the meeting. |

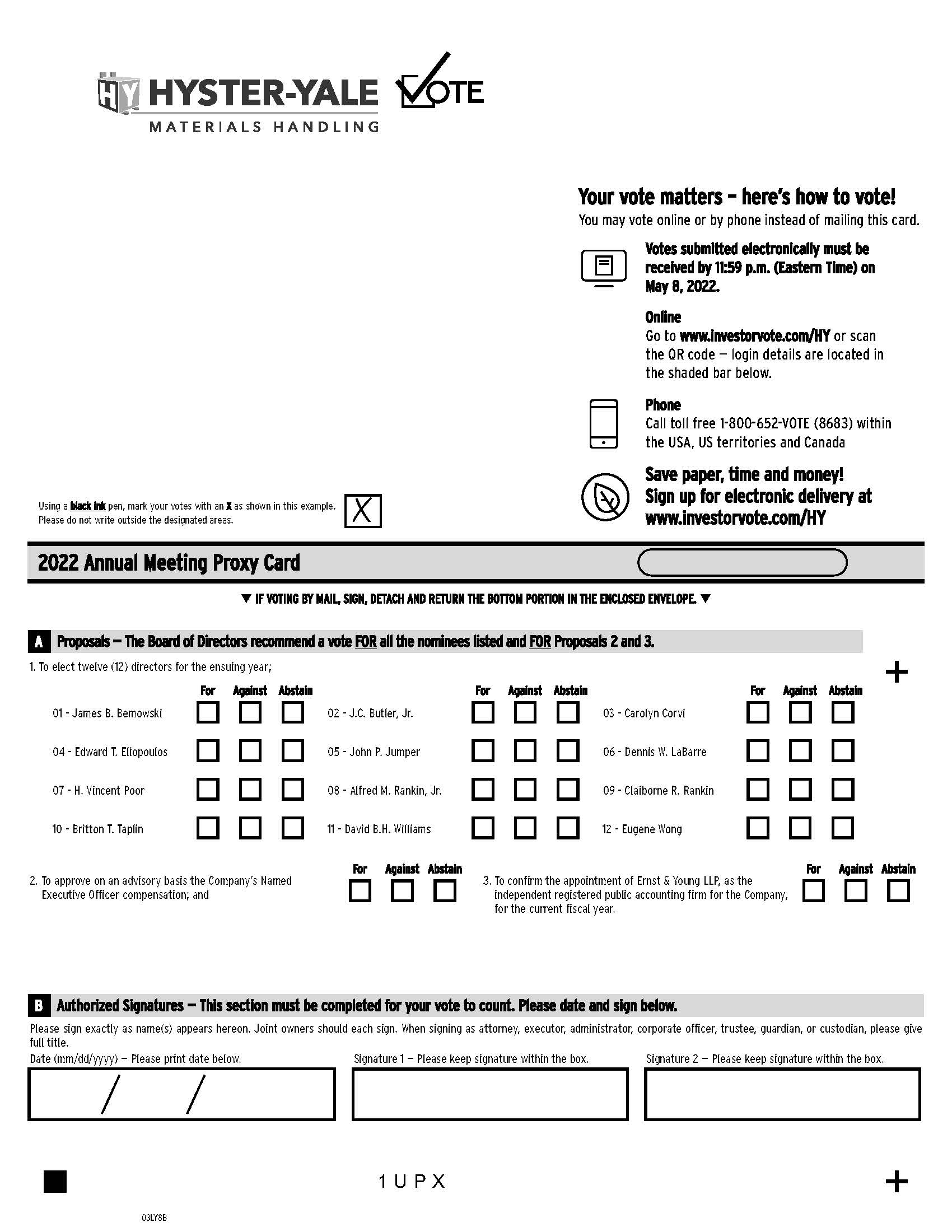

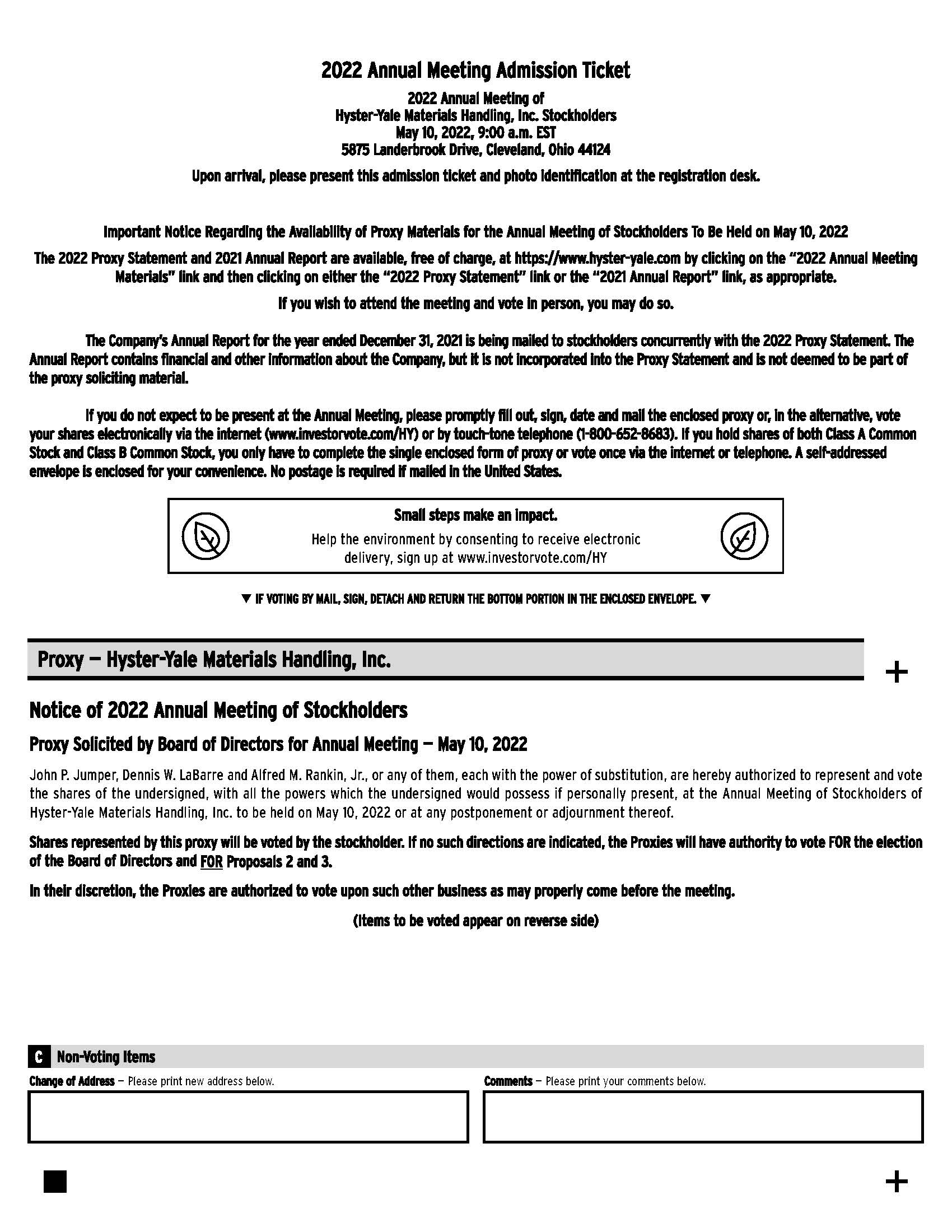

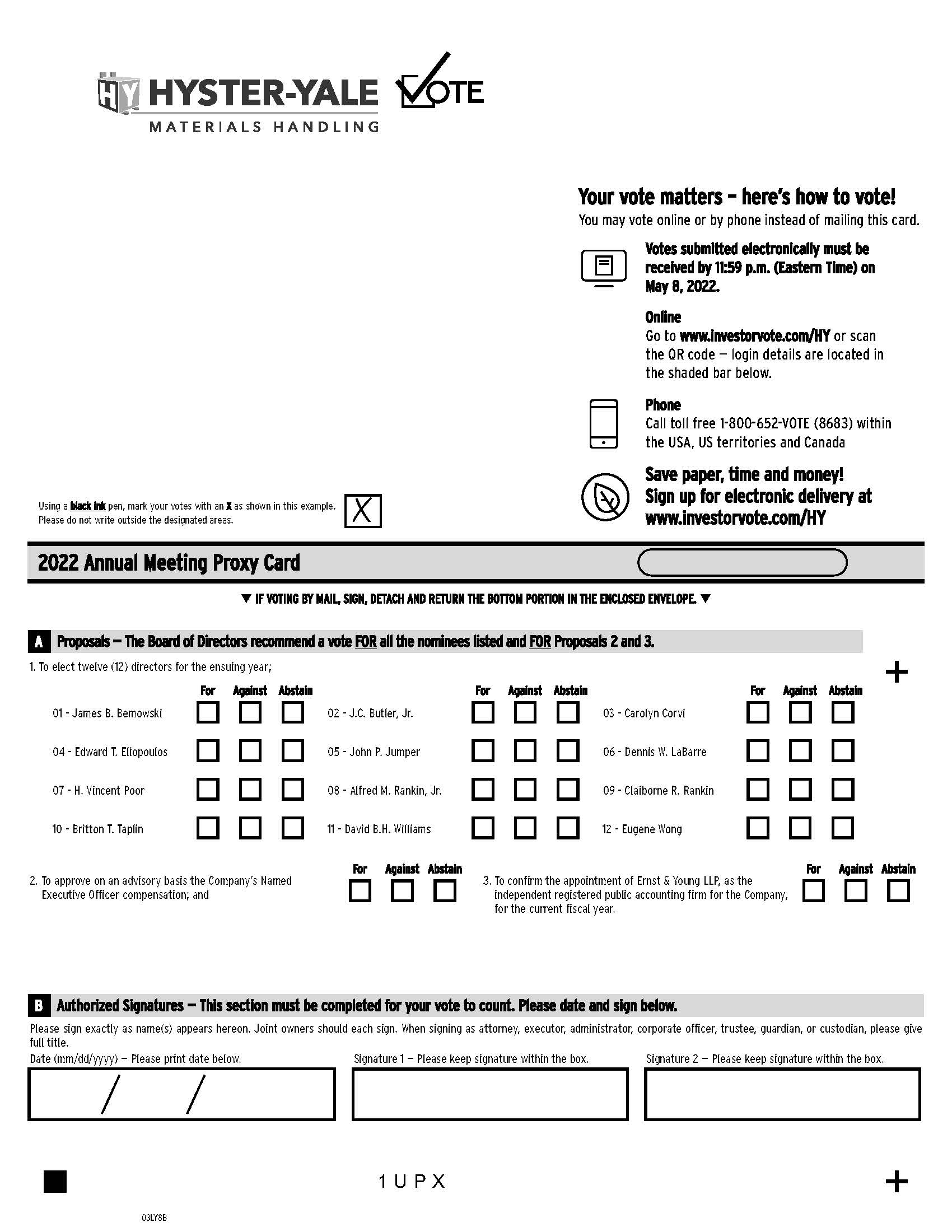

1.To elect twelve directors for the ensuing year;

2.To approve on an advisory basis the Company's Named Executive Officer compensation;

3. To confirm the appointment of Ernst & Young LLP, as the independent registered public accounting firm of the Company, for the current fiscal year; and

4. To conduct any other business as may properly come before the meeting.

The Board of Directors has fixed the close of business on March 18, 201922, 2022 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting and any adjournment thereof. The 20192022 Proxy Statement and related form of proxy are being mailed to stockholders commencing on or about March 26, 2019.

|

| |

| Suzanne Schulze Taylor |

| Secretary |

|

March 26, 201929, 2022

Important Notice Regarding the Availability of Proxy Materials for the

Annual Meeting of Stockholders To Be Heldto be held on May 17, 201910, 2022

The 20192022 Proxy Statement and 20182021 Annual Report are available, free of charge, at

http:https://www.hyster-yale.com by clicking on the "2019"2022 Annual Meeting Materials" link and then clicking on either the "2019"2022 Proxy Statement" link or the "2018"2021 Annual Report" link, as appropriate.

If you wish to attend the meeting and vote in person, you may do so.

The Company's Annual Report for the year ended December 31, 20182021 is being mailed to stockholders with the 20192022 Proxy Statement. The 20182021 Annual Report contains financial and other information about the Company, but it is not incorporated into the 20192022 Proxy Statement and is not deemed to be a part of the proxy soliciting material.

If you are a holder of record and do not expect to be present at the Annual Meeting, please promptly fill out, sign, date and mail the enclosed form of proxy or, in the alternative, vote your shares electronically via the internet (www.investorvote.com/HY) or by touch-tone telephone (1-800-652-8683). If you hold shares of both Class A Common Stock and Class B Common Stock, you only have to complete the single enclosed form of proxy or vote once via the internet or telephone. A self-addressed envelope is enclosed for your convenience. No postage is required if mailed in the United States. If your shares are held in street name"street name" by your broker, bank or other nominee, please follow the instructions provided by your broker, bank or other nominee.

5875 LANDERBROOK DRIVE, SUITE 300

CLEVELAND, OHIO 44124-4069 |

| | | | | | | | | | | | | |

PROXY STATEMENT — MARCH 26, 201929, 2022 |

This Proxy Statement is furnished in connection with the solicitation by the Board of Directors (the "Board of Directors" or the "Board") of Hyster-Yale Materials Handling, Inc., a Delaware corporation, of proxies to be used at the annual meeting of stockholders of the Company to be held on May 17, 201910, 2022 (the "Annual Meeting"). The terms the "Company," "Hyster-Yale," "we," "our" and "us" refer to Hyster-Yale Materials Handling, Inc. This Proxy Statement and the related form of proxy are being mailed to stockholders commencing on or about March 26, 2019.29, 2022.

If the enclosed form of proxy is executed, dated and returned or if you vote electronically, the shares represented by the proxy will be voted as directed on all matters properly coming before the Annual Meeting for a vote. Proxies that are properly signed without any indication of voting instructions will be voted as follows:

•for the election of each director nominee;

•to approve, on an advisory basis, the Company's Named Executive Officer compensation;

for the frequency of future advisory votes to approve, on an advisory basis, the Company's Named Executive Officer compensation to be set at one year;

to approve the Company's Non-Employee Directors' Equity Compensation Plan;

•for the confirmation of the appointment of Ernst & Young LLP, as the independent registered public accounting firm of the Company, for the current fiscal year; and

•as recommended by our Board of Directors with regard to any other matters or, if no recommendation is given, in the proxy holders' own discretion.

The proxies may be revoked at any time prior to their exercise by giving notice to us in writing or by executing and delivering a later dated proxy. Attendance at the Annual Meeting will not automatically revoke a proxy, but a stockholder of record attending the Annual Meeting may request a ballot and vote in person, thereby revoking a previously granted proxy.

Stockholders of record at the close of business on March 18, 201922, 2022 will be entitled to notice of, and to vote at, the Annual Meeting. On that date, we had 12,775,58113,103,709 outstanding shares of Class A Common Stock, par value $0.01 per share (the "Class A Common"), entitled to vote at the Annual Meeting and 3,875,763 3,795,671outstanding shares of Class B Common Stock, par value $0.01 per share (the "Class B Common"), entitled to vote at the Annual Meeting. Each share of Class A Common is entitled to one vote for a nominee for each of the eleventwelve directorships to be filled and one vote on each other matter properly brought before the Annual Meeting. Each share of Class B Common is entitled to ten votes for each such nominee and ten votes on each other matter properly brought before the Annual Meeting. Class A Common and Class B Common will vote as a single class on all matters anticipated to be brought before the Annual Meeting.

At the Annual Meeting, in accordance with Delaware law and our Bylaws, the inspectors of election appointed by the Board of Directors for the Annual Meeting will determine the presence of a quorum and will tabulate the results of stockholder voting. As provided by Delaware law and our Bylaws, the holders of a majority of our stock, issued and outstanding, and entitled to vote at the Annual Meeting and present in person or by proxy at the Annual Meeting, will constitute a quorum for the Annual Meeting. The inspectors of election intend to treat properly executed proxies marked "abstain" as "present" for purposes of determining whether a quorum has been achieved at the Annual Meeting. The inspectors of election will also treat proxies held in "street name" by brokers that are voted on at least one, but not all, of the proposals to come before the Annual Meeting ("broker non-votes") as "present" for purposes of determining whether a quorum has been achieved at the Annual Meeting.

In accordance with Delaware law, the eleventwelve director nominees receiving the greatest number of votes will be elected directors.

ProposalsProposal 2 and 3 areis advisory in nature and non-binding. Although non-binding, voting on the proposalsproposal will allow our Stockholdersstockholders to express their opinion regarding Named Executive Officer compensation and the frequency by which such advisory votes shall occur.compensation. Abstentions and broker non-votes will not be counted for purposes of such proposals.

In accordance with our Bylaws, the affirmative vote of the holders of a majority of the voting power of our stock that isare present in person or represented by proxy and that isare actually voted is required to approve all other proposals that are brought

before the Annual Meeting.confirmation of Ernst & Young LLP, as the independent registered public accountant for the Company, for the current fiscal year. As a result, abstentions and broker non-votes in respect of any such proposal will not be counted and will have no effect for purposes of determining whether a proposal has received the requisite approval by our stockholders. Because the proposal is considered "routine," brokers or other nominees will be able to vote shares with respect to this proposal without instructions and there will be no broker non-votes.

In accordance with Delaware law and our Bylaws, we may, by a vote of the stockholders, in person or by proxy, adjourn the Annual Meeting to a later date or dates, without changing the record date. If we were to determine that an adjournment was desirable, the appointed proxies would use the discretionary authority granted pursuant to the proxy cards to vote in favor of such an adjournment.

|

| | | | | | | | | | | | | |

| PART ONE - CORPORATE GOVERNANCE INFORMATION |

Directors are elected at each annual meeting to serve for a one-year term until the next annual meeting and/or until their respective successors are duly elected and qualified, subject to their earlier death, resignation or removal. During fiscal year 2018,2021, our Board of Directors consisted of eleventwelve directors.

|

| | | | | | | | | | | | | |

| Directors' Meetings and Committees |

The Board of Directors (the "Board of Directors" or the "Board") has an Audit Review Committee, a Compensation Committee, a Nominating and Corporate Governance Committee, a Compensation and Human Capital Committee, a Planning Advisory Committee, a Finance Committee and an Executive Committee. The current members and responsibilities of such committees are as follows: |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Independent | | Audit Review | | Compensation | | Nominating and Corporate Governance | | Compensation and Human Capital | | Planning Advisory | | Finance | | Executive |

| James B. Bemowski | | Yes | | | | | | | | X | | X | | |

| J.C. Butler, Jr. | | No | | | | | | | | | | X | | X | | |

| Carolyn Corvi | | Yes | | X | | X | | | | X | | X | | Chair | | X |

| Edward T. Eliopoulos* | | Yes | | Chair | | | | X | | | | | | X |

John P. JumperJumper* | | Yes | | X | | X | | Chair | | X | | | | | | X |

| Dennis W. LaBarre | | Yes | | X | | | | Chair | | | | X | | X | | X |

| H. Vincent Poor | | Yes | | | | X | | X | | | | | | |

| Alfred M. Rankin, Jr. | | No | | | | | | | | Chair | | X | | Chair |

| Claiborne R. Rankin | | No | | | | | | | | | | X | | |

John M. Stropki | | Yes | | Chair | | X | | X | | | | | | X |

| Britton T. Taplin | | Yes | | | | | | | | | | X | | |

| David B. H. Williams | | No | | | | | | | | | | X | | |

| Eugene Wong | | Yes | | X | | | | X | | | | | | | | |

*Audit Committee Financial Expert as determined by the SEC and NYSE listing standards.

Our Board of Directors held sevensix meetings in 2018.2021. During their tenure in 2018,2021, all of the directors attended at least 75% of the total meetings held by our Board of Directors and by the committees on which they served.

Our Board of Directors has determined that, based primarily onIn accordance with the ownership of Class A Common and Class B Common by the members of the Taplin and Rankin families and their voting history, we have the characteristics of, and may be, a "controlled company," as defined in Section 303Arules of the New York Stock Exchange ("NYSE") listing standards. While, our Board of Directors has determined that we could be characterized as a "controlled company," it has elected not to make use at the present time of any of the exceptions to the NYSE listing standards that are available to controlled companies.

In accordance with the rules of the NYSE, our non-managementindependent directors are scheduled to meet in executive session, without management, once a year. The Chairman of the Compensation Committee will preside at such meeting. Additional meetings of the non-managementindependent directors may be scheduled when the non-managementindependent directors believe such meetings are desirable. The determinationAs determined by the Board of the director who should preside at such additional meetings will be made based uponDirectors, the principal subject matter to be discussedof each meeting will determine which committee chair will preside at each such meeting. A meetingMeetings of the non-managementindependent directors, waswithout management, were held on May 12, 2021 and February 19, 2019.15, 2022.

We hold a regularly-scheduledregularly scheduled meeting of our Board of Directors in conjunction with our annual meeting of stockholders. Directors are expected to attend the annual meeting of stockholders absent an appropriate excuse. All of our directors who were directors onattended the date of our 2018 annual meeting of stockholders attended the2021 annual meeting in person, by telephone or by other electronic means.

|

| | | | | | | | | | |

| Audit Review Committee |

20182021 Meetings: 8 | | | |

| | | |

Members:6 | • | The Audit Review Committee has the responsibilities set forth in its charter, including: |

Carolyn CorviMembers: | | • | reviewing the quality and integrity of our financial statements; |

John P. JumperCarolyn Corvi | | • | monitoring our compliance with legal and regulatory requirements; |

Dennis W. LaBarreEdward T. Eliopoulos | | • | reviewing the adequacy of our internal controls; |

John M. Stropki (Chair) | | • | setting our guidelines and policies to monitor and control our major financial risk |

Eugene Wong | | | exposures; |

| John P. Jumper | | • | reviewing the qualifications, independence, selection and retention of the independent |

| Dennis W. LaBarre | | | registered public accounting firm; |

| Eugene Wong | | • | reviewing the performance of our internal audit function and independent registered |

| | | public accounting firm; |

| | • | assisting our Board of Directors and the Company in interpreting and applying our |

| | | Corporate Compliance Program and other issues related to corporate and employee ethics; |

| | | and |

| | • | preparing the Annual Report of the Audit Review Committee to be included in our |

| | | Proxy Statement.Statement; |

| | • | reviewing related-party transactions; |

| | • | reviewing and discussing corporate governance disclosures, including environmental, social and |

| | | governance ("ESG") disclosures; and |

| | • | reviewing and discussing matters related to information and cybersecurity. |

| • | No member of the Audit Review Committee serves on more than three public company audit committees. |

| • | The Board has determined that all members are independent and financially literate under NYSE |

| | under NYSE listing standards and rules of the U.S. Securities and Exchange Commission |

| | (the (the "SEC"). |

| • | The Board has determined that Mr. Stropki isEliopoulos and Mr. Jumper are each an "audit committee financial expert" as |

| | expert" as defined by the SEC and that heeach has accounting and related financial management expertise as |

| | required by NYSE listing standards. |

|

| | | | | | | | | | | | | |

| Nominating and Corporate Governance Committee |

2018 Meetings: 3 | | | |

| | | |

Members:2021 Meetings: 4 | • | The Nominating and Corporate Governance Committee (the "NCG Committee") has the | |

John P. JumperMembers: | | responsibilities set forth in its charter, including: | |

Dennis W. LaBarre (Chair)Carolyn Corvi | | • | reviewing and making of recommendations to our Board of Directors of the criteria | |

H. Vincent PoorJohn P. Jumper | | | for membership on our Board of Directors; | |

John M. StropkiDennis W. LaBarre (Chair) | | • | reviewing and making of recommendations to our Board of Directors of the optimum | |

| H. Vincent Poor | | | number and qualifications of directors believed to be desirable; | |

| | • | implementing and monitoring a system to receive suggestions for nominees to | |

| | | directorships of the Company; | |

| | • | identifying qualified candidates and making recommendations to our Board of Directors | |

| | | of specific candidates for membership on our Board of Directors; | |

| | • | reviewing our Corporate Governance Guidelines and recommending changes as | |

| | | appropriate; | |

| | • | overseeing evaluations of the Board of Directors' effectiveness; | |

| | • | annually reporting to the Board of Directors its assessment of our Board's performance; and | |

| | • | considering director candidates recommended by our stockholders, see "Procedures for | |

| | | Submission and Consideration of Director Candidates" on page 48.42; | |

| | • | recommending the creation or modification of Committees of the Board; | |

| | • | reviewing, at least annually, reports from management regarding the Company's policies, practices, | |

| | | performance and progress with respect to ESG issues; and | |

| | • | overseeing director education programs on relevant topics, including among other matters, | |

| | | ethics, compliance, governance, cybersecurity and matters relating to our business | |

| • | The Board has determined that all members are independent under NYSE listing standards. | |

| • | The NCG Committee may consult with members of the Taplin and Rankin families, | |

| | including Alfred M. Rankin, Jr. ("Mr. A. Rankin"), regarding the composition of our Board of Directors. | |

|

| | | | | | | | | | | | | |

| Compensation and Human Capital Committee | |

20182021 Meetings: 6 | | | |

| | | |

Members:5 | • | The Compensation and Human Capital Committee (the "Compensation Committee") has the | |

| Members: | | responsibilities set forth in its charter, including: | |

| Carolyn Corvi | | • | reviewing and approving corporate goals and objectives relevant to compensation; | |

| Edward T. Eliopoulos | | • | providing strategic guidance on the development of human capital strategies and programs to support | |

| John P. Jumper (Chair) | | | the Company's strategic business plan; | |

| H. Vincent Poor | | • | evaluating the performance of the Chief Executive Officer, whom we refer to | |

H. Vincent PoorEugene Wong | | | as our CEO, other executive officers and senior managers in light of these goals and | |

John M. Stropki | | | objectives; | |

Eugene Wong | | • | determining and approving of CEO, other executive officer and senior manager | |

| | | compensation levels; | |

| | • | establishing guidelines for administering the Company's compensation | |

| | | policies and programs for all employees; | |

| | • | considering whether the risks arising from our employee compensation policies and | |

| | | practices are reasonably likely to have a material adverse effect on the Company; | |

| | • | making recommendations to our Board of Directors, where appropriate or required, and | |

| | | the taking of other actions with respect to all other compensation matters, including incentive | |

| | | compensation plans and equity-based plans; | |

| | • | periodically reviewing the compensation of our Board of Directors; and | |

| | • | reviewing and approving the Compensation Discussion and Analysis and preparing | |

| | | the annual Compensation Committee Report to be included in our Proxy Statement. | |

| • | The Board has determined that all members are independent under the NYSE listing standards and | |

| | the rules of the SEC. | |

| • | The Compensation Committee may, in its discretion, delegate all or a portion of its duties and | |

| | responsibilities to one or more subcommittees of the Compensation Committee or, in appropriate | |

| | cases, to our senior managers. | |

| • | The Compensation Committee retains and receives assistance in the performance of its | |

| | responsibilities from an internationally recognized compensation consulting firm, discussed | |

| | under the heading "Compensation Consultants" on page 19.18. | |

|

| | | | | | | | | | |

| Planning Advisory Committee |

20182021 Meetings: 3 | | | |

| | | |

Members:5 | • | The Planning Advisory Committee has the responsibilities set forth in its charter, including: |

James B. BemowskiMembers: | | • | acting as a key participant, resource and adviser on various operational matters; |

Carolyn CorviJames B. Bemowski | | • | reviewing and advising on a preliminary basis possible acquisitions, divestitures, and other |

Dennis W. LaBarreJ.C. Butler, Jr. | | | transactions identified by management for possible consideration of the full Board of Directors; |

Alfred M. Rankin, Jr. (Chair)Carolyn Corvi | | • | considering and recommending to the Board of Directors special advisory roles for Directorsdirectors |

| Dennis W. LaBarre | | | who are not members of the Planning Advisory Committee; and |

| Alfred M. Rankin, Jr. (Chair) | | • | providing general oversight on behalf of the Board of Directors with respect to stockholder |

| | | interests and the Company's evolving structure and stockholder base. |

|

| | | | | | | | | | |

| Finance Committee |

20182021 Meetings: 3 | | | |

| | | |

Members: | • | The Finance Committee has the responsibilities set forth in its charter, including: |

James B. BemowskiMembers: | | • | reviewing the financing and financial risk management strategies for the Company and its |

J.C. Butler, Jr.James B. Bemowski | | | principal operating subsidiary; and |

Carolyn Corvi (Chair)J.C. Butler, Jr. | | • | making recommendations to the Board on matters concerning finance. |

| Carolyn Corvi (Chair) | | | |

| Dennis W. LaBarre | | | |

| Alfred M. Rankin, Jr. | | | |

| Claiborne R. Rankin | | | |

| Britton T. Taplin | | | |

| David B.H. Williams | | | |

|

| | | | | | | | | | |

| Executive Committee |

20182021 Meetings: 0 | | |

| | | |

Members: | • | The Executive CommitteeCommittee's responsibilities include: |

Carolyn Corvi | | • | include acting on behalf of the Board on matters requiring |

| Members: | | Board action between meetings of the full Board. |

| Carolyn Corvi | • | All members, except Mr. A. Rankin, are independent. |

| Edward T. Eliopoulos | | |

| John P. Jumper | | | of the full Board. |

| Dennis W. LaBarre | • | All members, except Mr. Rankin, are independent. | |

| Alfred M. Rankin, Jr. (Chair) | | | |

John M. Stropki | | | |

|

| | | | | | | | | | | | | |

| Board Leadership Structure |

The Board believes that it is prudent and in the best interests of stockholders that the CEO and Chairman positions be combined and that such combination has no negative effect on the operation or direction of the Company. Alfred M.Mr. A. Rankin, Jr., the Company's CEO, is the most appropriate person to serve as our Chairman because he possesses in-depth knowledge of the issues, opportunities and challenges facing our business. Because of this knowledge and insight, the Board of Directors believes that Mr. A. Rankin is in the best position to effectively identify strategic opportunities and priorities and to lead discussions regarding the execution of the Company's strategies and achievement of its objectives. As Chairman, our CEO is able to:

•focus our Board of Directors on the most significant strategic goals and risks of our business;

•utilize the individual qualifications, skills and experience of the other members of the Board of Directors to maximize their contributions to our Board of Directors;

•assess whether each other member of our Board of Directors has sufficient knowledge and understanding of our business to enable them to make informed judgments;

•promote a seamless flow of information to our Board of Directors;

•facilitate the flow of information between our Board of Directors and our management; and

•provide the perspective of a long-term stockholder.

In addition, Colin Wilsona separate CEO is responsible for the CEOday-to-day operations of our principal operating subsidiary, Hyster-Yale Group, Inc. ("HYG"), and as such is responsible for the day-to-day operations of the business.. This arrangement allows Mr. A. Rankin to focus almost exclusively on the strategic opportunities and priorities of the overall business.

We do not assign a lead independent director, but the Chairman of our Compensation Committee presides at the regularly-scheduleddirector. At meetings of non-management directors.the independent directors, the principal subject matter of each meeting determines the committee chair who will preside at such meeting.

|

| | | | | | | | | | | | | |

| Board Oversight of Risk Management |

The Board believes that strong and effective controls and risk management processes are essential components needed to achieve long-term stockholder value. The Board, directly and through its committees, is responsible for overseeing risks that potentially affect the Company. Each Board committee is responsible for oversight of risk categories related to the Committee'scommittee's specific function, while our full Board exercises ultimate responsibility for overseeing the risk management as a whole. The respective areas of risk oversight exercised by our Board and its committees are as follows:

|

| | | | | | | |

| Board/Committee | | Primary Areas of Risk Oversight |

| Full Board | • | Oversees overall Company risk management procedures, including operational and strategic, and regularly receives and evaluates reports and presentations from the Chairschairs of the Audit Review, NCG, Compensation, NCG, Planning Advisory and Finance Committees on risk-related matters falling within each respective committee's oversight responsibilities |

| Audit Review Committee | • | Oversees financial and legal risks by regularly reviewing reports and presentations given by management, including our Senior Vice President, General Counsel and Secretary, Senior Vice President and Chief Financial Officer, and Director, Internal Audit, as well as other operational Company personnel, and evaluates potential related-person transactions |

| • | Regularly reviews our risk management practices and risk-related policies (for example, the Company's Code of Corporate Conduct and legal and regulatory reviews) and evaluates potential risks related to internal control over financial reporting |

| • | Reviews risks related to ESG disclosures |

| • | Reviews risks related to information technology and cybersecurity, which includes reviewing the state of our cybersecurity program and emerging cybersecurity developments and threats, as well as steps management has taken to monitor and mitigate such exposures |

| NCG Committee | • | Oversees potential risks related to our governance practices by, among other things, reviewing succession plans and performance evaluations of the Board and CEO |

| | | | | | | | |

| Board/Committee | | Primary Areas of Risk Oversight |

| Compensation Committee | • | Oversees potential risks related to the design and administration of our compensation plans, policies and programs, including our performance-based compensation programs, to promote appropriate incentives that do not encourage unnecessary and excessive risk-taking by our executive officers or other employees |

| • | Provides strategic guidance and review on the development of human capital strategies and programs to support the Company's strategic business plan and reduce risks related to human capital issues |

| Planning Advisory Committee | • | Assists the Board in its oversight of the Company's key strategies, projects and initiatives |

| Finance Committee | • | Regularly reviews risks related to financing and other risk management strategies, including reviews of our insurance portfolios |

Planning Advisory Committee | • | Assists the Board in its oversight of the Company's key strategies, projects and initiatives |

Our Board has determined that, based primarily on the ownership of Class A Common and Class B Common by the members of the Taplin and Rankin families, we may qualify as a "controlled company," as defined in Section 303A of the listing standards of the NYSE. Under the listing standards of the NYSE, a controlled company is not required to comply with certain corporate governance requirements. Such requirements include having a majority of independent directors and having an audit review committee, nominating and corporate governance and compensation committee composed entirely of independent directors, each with written charters and annual performance evaluations for each committee.

Although Hyster-Yale may qualify as a controlled company, our Board evaluates its governance practices annually and has elected not to make use of any of the exceptions to the NYSE listing standards that are available to controlled companies. Accordingly, the majority of the members of our Board are independent, as described in the NYSE listing standards. Our Audit Review Committee, NCG Committee and Compensation Committee are all composed entirely of independent directors. Each committee has a written charter that describes the purpose and responsibilities of the committee, and each committee conducts an annual evaluation of its performance based on the responsibilities set forth in its charter.

The Board of Directors sets the tone for our Company and it provides a foundation for strong governance practices. Our Board reflects a balance of longer-tenured members with in-depth knowledge of our business, and newer members who bring valuable additional attributes, skills and experience. We believe this combination results in a well-balanced membership that combines a diversity of experience, skill and intellect in order to enable the Company to pursue its strategic objectives effectively.

Recently, the Company undertook a review of its Audit Review, Compensation and NCG Committees' charters and, after discussion with the Board, the charters were amended. The charters were revised to reflect which Committee has responsibility for various ESG matters and information technology and cybersecurity. In addition, the Compensation Committee was renamed the Compensation and Human Capital Committee to more accurately reflect the scope of its responsibilities.

We operate our business with a long-term view and have established goals and strategic initiatives to help us achieve our long-term business objectives. A broad program designed to ensure a strong focus on corporate responsibility is built into our strategic initiatives and underlies our overall strategic planning process. We believe that incorporating corporate responsibility into our Company strategy will bring the best long-term value to our stockholders. By striving for environmental, social, and economic health throughout our organization, we believe we are serving the long-term best interests of the Company while contributing to solving challenges that effect our customers and the communities in which we do business.

Environmental Health and Safety Responsibility

We are committed to accomplishing our business objectives in a manner that complies with our environmental health and safety obligations and requires all Company personnel to be responsible for their assurance, as outlined in the Code of Corporate Conduct. All Company personnel, contractors and suppliers are required to adhere to the following guidelines:

•comply with applicable environmental, health and safety requirements;

•advise supervisors of any potential environmental or safety hazards;

•keep all work areas free from environmental, health and safety hazards; and

•fulfill compliance obligations of the Company and government agencies.

In 2016, we established our 2026 Vision Program which, in part, established programs to be cost effectively achieved compared with a 2015 baseline as follows:

•strive to reduce carbon emission;

•strive to reduce volatile organic compound emissions from painting operations;

•strive to achieve zero waste to landfills at all sites;

•strive to reduce hazardous waste;

•strive to mitigate our waste footprint across all aspects of our value chain by reducing, reusing and recycling effluents and waste;

•strive to reduce water consumption; and

•strive to offer alternatives that enable customers to cost effectively reduce carbon emissions.

We continue to responsibly manage products and packaging to make further progress with the projects set forth in the 2026 Vision Program. While we have generally made progress, year-over-year progress was limited by COVID-19 labor shortages and supply chain disruptions from 2019 to 2021.

We believe our ownership of Nuvera is a transformational opportunity to be a global leader in a key emerging technology with the potential for zero emissions that can also provide enhanced productivity for heavy-duty motive power applications and for certain forklift truck applications. Our objective for Nuvera is to be the preferred provider of heavy-duty fuel cell engines for zero-emissions mobility customers. Global interest in clean energy, as well as strong interest in Nuvera products by third parties, is increasingly supporting the achievement of this objective.

In recognition of continued leadership in supplier sustainability initiatives, the Company's Hyster® brand was listed as an Inbound Logistics’ Top 75 Green Supply Chain Partners for the tenth consecutive year due largely to its lithium-ion and hydrogen fuel cell power systems and telemetry solutions.

Social

The Company considers its commitment to people, including its employees, customers and the local community, as a primary focus of corporate responsibility. The Company’s priority on people focuses on six main areas: occupational health and safety, customer health and safety, employment, training and education, diversity and equal opportunity, and engagement with local communities.

Occupational Health and Safety

Strong health and safety performance is essential to the success of the Company. The framework includes the monitoring and measurement of key performance indicators as we strive to ensure the health and safety of employees. We believe injury and illness should be avoided, and require all employees to be effectively trained and responsible for the assurance of safety on a daily basis. Employees are encouraged to initiate safety improvements, participate in safety committees and reinforce safety behaviors at all times. We are striving to reduce the injury and illness rates in our global operations to zero by 2026. Our most recent metrics from 2020 showed an approximately 10% reduction in the injury and illness rates from the 2015 baseline.

To protect the Company's employees while maintaining essential business functions, we implemented COVID-19 protocols and safety measures. Examples of these protocols include restricting travel, implementing a remote working policy where able, face covering policies and asking employees to practice self-health monitoring to further minimize potential exposure and spread of the virus. As appropriate, we have also adjusted medical benefits to allow for earlier medication refills, waived fees for virtual care services and encouraged employees to consider the COVID-19 vaccine as part of their ongoing personal safety measures. Social distancing practices such as decreasing the number of employees working closely together, adjusting workflows and pathways, installing physical protective barriers, limiting access to communal areas (i.e., break room, cafeteria), and increasing the cleaning, sanitizing, and/or disinfecting of areas within our facilities continues.

At the beginning of the pandemic, we established divisionally specific processes for tracking and reviewing employee COVID-19 cases. Whenever a confirmed diagnosis or potential exposure to COVID-19 occurred, teams took action to contain the situation by implementing appropriate testing or quarantine requirements, focused cleaning and sanitization while informing employees of any potential risks.

Our protocols have and continue to be guided by the guidance of the World Health Organization, the Center for Disease Control, Federal/State Occupational Safety, and other governmental and health authorities. Communication and reinforcement of our COVID-19 protocols have been maintained through our "COVID-19 Pandemic Guide" and ongoing communications to all employees through a variety of methods and channels.

Customer Health & Safety

The Company manages its compliance with government and industry product safety information. Many new products follow a structured and rigorous six-stage development process, with lift truck production taking place within ISO- and OHSAS-certified manufacturing sites. Each of the Company's manufacturing sites uses rigorous processes and testing to seek to ensure that its products meet or exceed application requirements.

In addition, the Company provided support and resources to our dealer network and customers to aid them in their response to the COVID-19 pandemic. This included tools, materials, and training through our "Dealer Portal," connections with leadership teams, and regular and consistent communications. An example of the programs provided was the development and launch of "HY-Shield Clean," a lift truck sanitization program designed to help keep facility personnel safe during operation of

lift trucks, including daily operation and service calls. This was launched to help customers deal with fast-changing conditions and maintain operations during the pandemic.

Employment

The Company recognizes the sustainability of its culture and its long-term success is strengthened when employees are respected, motivated and engaged. The Company works to match employees with assignments to capitalize on the skills, talents and potential of each employee.

The Company maintains seven core competencies for senior employees: be innovative, be strategic, engage others, demonstrate presence, drive for results, develop, empower and demonstrate business acumen.

Training and Education

The Company encourages employees to pursue professional and personal development through training and educational opportunities such as the Company's "Learning and Development Guide" and its "Hyster-Yale Learning Center." Each employee is provided access to the guide and the digital learning platform offering a wide variety of development opportunities with little or no cost to employees. In addition, many of our employees are required to complete annual Code of Corporate Conduct training and monthly cybersecurity training.

Diversity and Equal Opportunity

The Company believes in hiring, engaging, developing and promoting people who are fully able to meet the demands of each position, regardless of race, color, religion, gender, sexual orientation, gender identity, national origin, age, veteran status or disability. The Company conducts surveys to monitor its performance in these areas.

The Company sponsors several employee resource groups that support employees, including the HYG Women's Network, the Veteran's Network and the Young Professional Network.

Engagement with Local Communities

As a major employer within our operating locations, the Company supports its local communities and is committed to helping them remain safe, healthy and resilient. The Company's activities include corporate donations, volunteerism and education.

Supply Chain Practices

Our supply network includes both large international suppliers as well as smaller specialized providers, all of which are required to meet the stringent requirements outlined in our Supplier Quality Manual and Code of Corporate Conduct for Business Partners.

As part of our supplier screening process, we require all direct materials suppliers to ensure that they and their suppliers are compliant with our UK Modern Slavery and Forced Labor Statements, Conflict Minerals Policy and Supplier Expectations Manual and applicable data privacy and environmental laws.

| | | | | | | | | | | | | | |

| Code of Corporate Conduct |

We have adopted a code of ethics, entitled "Code of Corporate Conduct," applicable to all of our personnel, including the principal executive officer, principal financial officer, principal accounting officer, controller and other persons performing similar functions. Waivers of our Code of Corporate Conduct, if any, for our directors or executive officers may be disclosed on our website, by press release or by filing a Current Report on Form 8-K with the SEC. The Code of Corporate Conduct and the Independence Standards for Directors, as well as each of the charters of the Audit Review, CompensationNCG and NCGCompensation Committees, are available free of charge on our website at http:https://www.hyster-yale.com, under the heading "Corporate Governance." The information contained on or accessible through our website is not incorporated by reference into this Proxy Statement and you should not consider such information to be part of this Proxy Statement.

| | | | | | | | | | | | | | |

| Hedging and Speculative Trading Policies and Limited Trading Windows |

The Company prohibits officers and directors from purchasing financial instruments, including pre-paid variable forward contracts, equity swaps, collars and exchange funds, or otherwise engaging in transactions that are designed or have the effect of hedging or offsetting any change in the market value of equity securities granted to the officer or director by the Company as part of his or her compensation or held, directly or indirectly, by the officer or director. However, the Company does not prohibit its employees who are not officers from engaging in such transactions.

As noted elsewhere in this Proxy Statement, restricted shares of Class A Common that are issued to directors and certain senior management employees of the Company for compensatory purposes are generally subject to transfer restrictions from the last day of the applicable performance period and, during that time period, the restricted shares may not be transferred (subject to certain exceptions) or hedged. Directors and the most senior management employees of the Company are required to hold restricted shares for ten years while less senior management employees of the Company are required to hold restricted shares for periods of either four years or seven years. While the Company does not have a policy explicitly preventing employees, including executive officers and senior managers, or directors from pledging shares of non-restricted Class A

Common or Class B Common, prior approval from the Company's Senior Vice President, General Counsel and Secretary is required.

| | | | | | | | | | | | | | |

Review and Approval of Related PartyRelated-Party Transactions |

The Audit Review Committee reviews all relationships and transactions in which we and our directors and executive officers or their immediate family members are participants to determine whether such persons have a direct or indirect material interest in such transactions. Our legal department is primarily responsible for the development and implementation of processes and controls to obtain information from the directors and executive officers with respect to related-person transactions in order to enable the Audit Review Committee to determine whether we have, or a related-personrelated person has, a direct or indirect material interest in the transaction. In the course of the review of a potentially-materialpotentially material related-person transaction, the Audit Review Committee considers:

•the nature of the related-person's interest in the transaction;

•the material terms of the transaction, including, without limitation, the amount and type of transaction;

•the importance of the transaction to the related-person;related person;

•the importance of the transaction to the Company;

•whether the transaction would impair the judgment of a director or executive officer to act in our best interest; and

•any other matters the Audit Review Committee deems appropriate.

Based on this review, the Audit Review Committee will determine whether to approve or ratify any transaction that is directly or indirectly material to us or a related-person.related person.

Any member of the Audit Review Committee who is a related-personrelated person with respect to a transaction under review may not participate in the deliberations or vote with respect to the approval or ratification of the transaction. However, such director may be counted in determining the presence of a quorum at a meeting of the Audit Review Committee that considers the transaction.

|

| | | | | | | | | | | | | |

| Communication with Directors |

Our stockholders and other interested parties may communicate with our Board of Directors as a group, with the non-management directors as a group, or with any individual director by sending written communications toto: Hyster-Yale Materials Handling, Inc., 5875 Landerbrook Drive, Suite 300, Cleveland, Ohio 44124-4069, Attention: Secretary. Complaints regarding accounting, internal accounting controls or auditing matters will be forwarded directly to the Chairman of the Audit Review Committee. All other communications will be provided to the individual director(s) or group of directors to whom they are addressed. Copies of all communications will be provided to all other directors; provided, however, that any such communications that are considered to be improper for submission to the intended recipients will not be provided to the directors. Examples of communications that would be considered improper for submission include, without limitation, customer complaints, solicitations, communications that do not relate, directly or indirectly, to our or our principal operating subsidiary's business or communications that relate to improper or irrelevant topics.

|

| | | | | | | | | | | | | |

| Report of the Audit Review Committee |

The Audit Review Committee has reviewed and discussed with our management and Ernst & Young LLP, our independent registered public accounting firm, our audited consolidated financial statements contained in our Annual Report to Stockholders for the year ended December 31, 2018.2021. The Audit Review Committee also has reviewed and discussed with management and Ernst & Young LLP the assessment of the Company’s internal control over financial reporting at December 31, 2018.2021.

The Audit Review Committee has also discussed with our independent registered public accounting firm the matters required to be discussed byapplicable requirements of the Public Company Accounting Oversight Board (PCAOB) Auditing Standard 1301, “Communications with Audit Committees”.(the "PCAOB") and the SEC.

The Audit Review Committee has received and reviewed the written disclosures and the independence letter from Ernst & Young LLP required by applicable requirements of the PCAOB regarding Ernst & Young LLP's communications with the Audit Review Committee concerning independence, and has discussed with Ernst & Young LLP its independence.

Based on the review and discussions referred to above, the Audit Review Committee recommended to the Board of Directors (and the Board of Directors subsequently approved the recommendation) that the audited consolidated financial statements for 20182021 be included in our Annual Report on Form 10-K for the year ended December 31, 2018,2021, filed with the SEC.

EDWARD T. ELIOPOULOS (CHAIR)

JOHN M. STROPKI, CHAIRP. JUMPER

CAROLYN CORVI

JOHN P. JUMPER

DENNIS W. LABARRE

EUGENE WONG

|

| | | | | | | | | | | | | |

PART TWO - PROPOSALS TO BE VOTED ON AT THE 20192022 ANNUAL MEETING |

|

| | | | | | | | | | | | | |

| Election of Directors (Proposal 1) |

|

| | | | | | | | | | | | | |

| Director Nominee Information |

It is intended that shares represented by proxies in the enclosed form will be voted for the election of the nominees named in the following table to serve as directors for a term until the next annual meeting and until their successors are elected, unless contrary instructions are received. The Board of Directors has fixed the total number of directors to be elected at the Annual Meeting at eleven.twelve. All of the nominees listed below presentlycurrently serve as our directors and were elected at our 2018 Annual Meeting2021 annual meeting of Stockholders.stockholders. If, in the judgment of the proxy holders, an unexpected occurrence should make it necessary to substitute another person for any of the nominees, shares represented by proxies will be voted for such other person as the proxy holders may select.

The disclosure below provides information as of the date of this Proxy Statement about each director nominee. The information presented is based upon information each director has given us about his or her age, all positions held, principal occupation and business experience for the past five years, and the names of other publicly-heldpublicly held companies for which he/she currently serves as a director or has served as a director during the past five years. We have also presented information regarding each nominee's specific experience, qualifications, attributes and skills that led our Board of Directors to the conclusion that he/she should serve as a director. We believe that the nomination of each of our director nominees is in the best long-term interests of our stockholders, as each individual possesses the highest personal and professional ethics, integrity and values, and each nominee has the judgment, skill, independence and experience required to serve as a member of our Board of Directors. Each individual has also demonstrated a strong commitment to service to the Company.

| | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Principal Occupation and Business Experience During Last Five Years and other Directorships in Public Companies | | Director Since |

| James B. Bemowski | | 68 | | Senior Advisor for Doosan Corporation (a South Korean Conglomerate), from prior to 2017 to 2018; since prior to 2017, a member of Claremont McKenna College Board of Trustees, a member of the Board of Advisors of Southern Capital (a Singapore-based private equity firm); and since prior to 2017 to 2018, Chairman of the Global Advisory Board of Yonsei University Business School.

With greater than 36 years of combined experience through his various positions with Doosan and McKinsey & Company, as a director and officer manager in Asia, Mr. Bemowski brings a depth of understanding of Asian market business practices, including in the forklift business. In addition, he has extensive knowledge in the areas of financial services, acquisitions, restructuring, alliances and private equity. He also brings to our Board practical insights with respect to the global steel, energy and materials businesses. | | 2018 |

| J.C. Butler, Jr. | | 61 | | President and Chief Executive Officer of NACCO Industries, Inc. ("NACCO") (a mining and natural resources company) since September 2017. President and Chief Executive Officer of The North American Coal Corporation ("NACoal", a wholly owned subsidiary of NACCO) since prior to 2017. Senior Vice President - Finance, Treasurer and Chief Administrative Officer of NACCO from prior to 2017 to September 2017. Director of NACCO since September 2017 and of Hamilton Beach Brands Holding Company ("HBBHC") (a designer, manufacturer and distributor of home appliances and commercial restaurant equipment) since September 2017. From prior to 2017 to present, Director of Midwest AgEnergy Group (a developer and operator of ethanol facilities in North Dakota). Mr. Butler also serves on the board of the National Mining Association and is a member of the Management Committee of the Lignite Energy Council.

With over 20 years of service as a member of senior management at NACCO while we were its wholly owned subsidiary, including as Treasurer of HYG, our principal operating subsidiary, Mr. Butler has extensive knowledge of our operations and strategies. | | 2012 |

| Carolyn Corvi | | 70 | | Retired Vice President and General Manager - Airplane Programs of The Boeing Company (an aerospace company). From prior to 2017 to present, Director of United Continental Holdings, Inc. From prior to 2017 to present, Director of Allegheny Technologies, Inc.

Ms. Corvi's experience in general management, including her service as vice president and general manager of a major publicly traded corporation, enables her to make significant contributions to our Board of Directors. Through this past employment experience and her past and current service on the boards of publicly traded corporations, she offers the Board a comprehensive perspective for developing corporate strategies and managing risks of a major publicly traded corporation. | | 2012 |

| | | | | | |

| | | Name | | Age | | Principal Occupation and Business Experience During Last Five Years and other Directorships in Public Companies | | Director Since | Name | | Age | | Principal Occupation and Business Experience During Last Five Years and other Directorships in Public Companies | | Director Since |

| James B. Bemowski | | 65 | | Retired Vice Chairman of Doosan Group; Chief Executive Officer of Doosan Corporation Business Operations from prior to 2014 to August 2015; Senior Advisor for Doosan Corporation (a South Korean Conglomerate) from 2016 to 2018. Director of POSCO (a multi-national steel company) from prior to 2014 to 2015; since prior to 2014 a member of Claremont McKenna College Board of Trustees, a member of the Board of Advisors of Southern Capital (a Singapore-based private equity firm); and since prior to 2014 to 2018 Chairman of the Global Advisory Board of Yonsei University Business School.

Through his combined 35 years of experience with Doosan, as well as with McKinsey & Company, where he was a senior partner and manager of Asian offices, Mr. Bemowski brings a depth of understanding of Asian market business practices, including in the forklift business. In addition, he has extensive knowledge in the areas of financial services, acquisitions, restructuring, alliances and private equity. He also brings to our Board practical insights with respect to the global steel, energy and materials businesses. | | 2018 | |

| J.C. Butler, Jr. | | 58 | | President and Chief Executive Officer of NACCO Industries, Inc. (“NACCO”) since October 2017. President and Chief Executive Officer of The North American Coal Corporation (“NACoal”, a wholly-owned subsidiary of NACCO) since July 2015. Senior Vice President - Finance, Treasurer and Chief Administrative Officer of NACCO from prior to 2014 to September 2017. Senior Vice President - Project Development, Administration and Mississippi Operations of NACoal from July 2014 to July 2015, and Senior Vice President - Project Development and Administration of NACoal from prior to 2014 to July 2014. Director of NACCO since September 2017 and of Hamilton Beach Brands Holding Company since September 2017. Director of Midwest AgEnergy Group (a developer and operator of ethanol facilities in North Dakota) since January 2014. Serves on the board of the National Mining Association and is a member of the Management Committee of the Lignite Energy Council.

With over 20 years of service as a member of senior management at NACCO while we were its wholly-owned subsidiary, including as Treasurer of HYG, our principal operating subsidiary, Mr. Butler has extensive knowledge of our operations and strategies. | | 2012 | |

| Carolyn Corvi | | 67 | | Retired Vice President and General Manager - Airplane Programs of The Boeing Company (an aerospace company). Director of United Continental Holdings, Inc. and Allegheny Technologies, Inc.

Ms. Corvi's experience in general management, including her service as vice president and general manager of a major publicly-traded corporation, enables her to make significant contributions to our Board of Directors. Through this past employment experience and her past and current service on the boards of publicly-traded corporations, she offers the Board a comprehensive perspective for developing corporate strategies and managing risks of a major publicly-traded corporation. | | 2012 | |

| Edward T. Eliopoulos | | Edward T. Eliopoulos | | 65 | | Retired Partner of Ernst & Young, LLP (a public accounting firm).

Mr. Eliopoulos is a certified public accountant with more than 42 years of experience performing, reviewing, and overseeing audits of a wide range of global publicly traded companies. In addition, he has significant experience as a member of senior management of a major public accounting firm. These attributes, skills, and qualifications combined with his educational background in accounting enable him to provide our Board with vast financial, accounting, and corporate governance expertise. Mr. Eliopoulos also has served on the board of A. Schulman, Inc., as well as privately held companies and numerous non-profit and community boards. | | 2020 |

| John P. Jumper | | 74 | | Retired Chief of Staff, United States Air Force. Chairman of the Board of Leidos Holdings, Inc. (an applied technology company) from prior to 2014 to June 2015. Chief Executive Officer of Leidos Holdings, Inc. from prior to 2014 to 2014. Director of Leidos Holding, Inc. from prior to 2014 to 2018. President, John P. Jumper & Associates (aerospace consulting) from prior to 2014. General Jumper also serves as a Director of NACCO, Hamilton Beach Brands Holding Company.

Through his extensive military career, including as the highest-ranking officer in the U.S. Air Force, General Jumper developed valuable and proven leadership and management skills that make him a significant contributor to our Board. In addition, General Jumper's current and prior service on the boards of other publicly-traded corporations, as well as Chairman and Chief Executive Officer of two Fortune 500 companies, allow him to provide valuable insight to our Board on matters of corporate governance and executive compensation policies and practices. | | 2012 | John P. Jumper | | 77 | | Retired Chief of Staff, United States Air Force. From prior to 2017, President, John P. Jumper & Associates (aerospace consulting). From prior to 2017 to present, Director of NACCO. From September 2017 to present, Director of HBBHC. From prior to 2017 to May 2018, Director of Leidos Holdings, Inc. ("Leidos").

Through his extensive military career, including as the highest-ranking officer in the U.S. Air Force, General Jumper developed valuable and proven leadership and management skills that make him a significant contributor to our Board. General Jumper's current and prior service on the boards of other publicly traded corporations, as well as chairman and chief executive officer of two Fortune 500 companies, allow him to provide valuable insight to our Board on matters of corporate governance and executive compensation policies and practices. In addition, General Jumper brings extensive cybersecurity knowledge and expertise to our Board. His cybersecurity experience includes overseeing the creation of the first information warfare squadron in the U.S. Air Force during his tenure leading the U.S. Air Force and also serving as CEO of Leidos which is a leading federal cybersecurity contractor for the U.S. Department of Defense, U.S. Department of Homeland Security and United States Intelligence Communities including the National Security Agency. | | 2012 |

| Dennis W. LaBarre | | 76 | | Retired Partner of Jones Day (a law firm). From January 2014 to December 2014, Of Counsel of Jones Day. Mr. LaBarre serves as a Director of NACCO and Hamilton Beach Brands Holding Company.

Mr. LaBarre is a lawyer with broad experience counseling boards and senior management of publicly-traded and private corporations regarding corporate governance, compliance and other domestic and international business and transactional issues. In addition, he has over 30 years of experience as a member of senior management of a major international law firm. These experiences enable him to provide our Board of Directors with an expansive view of legal and business issues, which is further enhanced by his extensive knowledge of us as a result of his many years of service on NACCO's board and through his involvement with its committees. | | 2012 | Dennis W. LaBarre | | 79 | | Retired Partner of Jones Day (a law firm). From prior to 2017 to present, Director of NACCO. From September 2017 to present, Director of HBBHC.

Mr. LaBarre is a lawyer with broad experience counseling boards and senior management of publicly traded and private corporations regarding corporate governance, compliance and other domestic and international business and transactional issues. In addition, he has over 30 years of experience as a member of senior management of a major international law firm. These experiences enable him to provide our Board of Directors with an expansive view of legal and business issues, which is further enhanced by his extensive knowledge of us as a result of his many years of service on NACCO's board and through his involvement with its committees. | | 2012 |

| H. Vincent Poor | | H. Vincent Poor | | 70 | | Michael Henry Strater University Professor of Electrical Engineering at Princeton University since prior to 2017; Professor of Electrical Engineering since prior to 2017; Associated Faculty, Princeton Environmental Institute since prior to 2017; Associated Faculty, Program in Applied and Computational Mathematics since prior to 2017; Associated Faculty, Andlinger Center for Energy and Environment since prior to 2017; Director, IEEE Foundation since prior to 2017; and Director, Corporation for National Research Initiatives since prior to 2017 to 2020. A member of the U.S. National Academy of Engineering and a former Guggenheim Fellow.

Dr. Poor’s broad experience in the fields of signal processing, machine learning and data science have opened new horizons in wireless communications and related fields. In this context, his extensive skills and knowledge allow him to provide valuable insight to our Board on matters related to telemetry and electrical engineering. | | 2017 |

| Alfred M. Rankin, Jr. | | Alfred M. Rankin, Jr. | | 80 | | Chairman and Chief Executive Officer of the Company and Chairman of HYG since prior to 2017. President of the Company since prior to 2017 to February 2021. Since September 2017, Non-Executive Chairman of NACCO and NACCO’s principal subsidiary, NACoal. Since January 2019, Non-Executive Chairman of HBBHC and its principal subsidiary, Hamilton Beach Brands ("HBB"). From September 2017 to December 2018, Executive Chairman of HBBHC and HBB. From prior to 2017 to September 2017, Chairman of HBB. From prior to 2017 to September 2017, Chairman, President, and CEO of NACCO and Chairman of NACoal.

In over 45 years of service to NACCO, our former parent company, as a Director and over 25 years in senior management of NACCO and approximately 10 years in senior management of the Company, Mr. A. Rankin has amassed extensive knowledge of all of our strategies and operations. In addition to his extensive knowledge of the Company, he also brings to our Board unique insight resulting from his service on the boards of other publicly traded corporations and the Federal Reserve Bank of Cleveland. Additionally, through his dedicated service to many of Cleveland’s cultural institutions, he provides a valuable link between our Board, the Company, and the community surrounding our corporate headquarters. Mr. A. Rankin is also the grandson of the founder of NACCO and additionally brings the perspective of a long-term stockholder to our Board. | | 2012 |

|

|

| | | | | | |

| Name | | Age | | Principal Occupation and Business Experience During Last Five Years and other Directorships in Public Companies | | Director Since |

| H. Vincent Poor | | 67 | | Michael Henry Strater University Professor of Electrical Engineering at Princeton University since prior to 2014; Professor of Electrical Engineering since prior to 2014; Associated Faculty, Princeton Environmental Institute since prior to 2014; Associated Faculty, department of Operations Research & Financial Engineering since prior to 2014; Associated Faculty, Program in Applied and Computational Mathematics since prior to 2014; Associated Faculty, Andlinger Center for Energy and Environment since 2014; Dean, School of Engineering and Applied Science from prior to 2014 to 2016; Director, IEEE Foundation since 2015; and Director, Corporation for National Research Initiatives since prior to 2014. A member of the U.S. National Academy of Engineering and a former Guggenheim Fellow.

Dr. Poor’s broad experience in the fields of robust statistical signal processing, multi-user detection and non-Gaussian signal processing have opened new horizons in wireless communications and related fields. In this context, his extensive skills and knowledge allow him to provide valuable insight to our Board on matters related to telemetry and electrical engineering. | | 2017 |

| Alfred M. Rankin, Jr. | | 77 | | Chairman, President, and Chief Executive Officer of the Company and Chairman of HYG. Since September 2017 Non-Executive Chairman of NACCO Industries and since prior to 2014 Chairman of NACCO’s principal subsidiary, North American Coal. From September 2017 to December 2018 Executive Chairman of Hamilton Beach Brands Holding Company. Since January 2019 Non-Executive Chairman of Hamilton Beach Brands Holding Company. Since prior to 2014 Chairman of Hamilton Beach Brands Holding Company’s principal subsidiaries, Hamilton Beach Brands, Inc. and The Kitchen Collection, LLC. From prior to 2014 to September 2017 Chairman, President, and CEO of NACCO Industries. From prior to 2014 to October 2014, Director of The Vanguard Group.

In over 45 years of service to NACCO, our former parent company, as a Director and over 25 years in senior management of NACCO, Mr. Rankin has amassed extensive knowledge of all of our strategies and operations. In addition to his extensive knowledge of the Company, he also brings to our Board unique insight resulting from his service on the boards of other publicly-traded corporations, The Vanguard Group and the Federal Reserve Bank of Cleveland. Additionally, through his dedicated service to many of Cleveland’s cultural institutions, he provides a valuable link between our Board, the Company, and the community surrounding our corporate headquarters. Mr. Rankin is also the grandson of the founder of NACCO and additionally brings the perspective of a long-term stockholder to our Board. | | 2012 |

| Claiborne R. Rankin | | 68 | | Manager of NCAF Management, LLC, the managing member of North Coast Angel Fund, LLC (a private firm specializing in venture capital and investments) from prior to 2014. Managing Member of Sycamore Partners, LLC, the manager of NCAF Management II, LLC and managing member of North Coast Angel Fund II, LLC (each a private firm specializing in venture capital and investments) from prior to 2014.

Mr. Rankin is the grandson of the founder of NACCO. As a member of the board of HYG for more than 20 years, Mr. Rankin has extensive knowledge of the lift truck industry and the Company. This experience and knowledge, his venture capital experience and the perspective of a long-term stockholder enable him to contribute to our Board of Directors. | | 2012 |

| John M. Stropki | | 68 | | Retired Executive Chairman, Lincoln Electric Holding, Inc. (a welding products company). From prior to 2014 Director of the Sherwin Williams Company and Rexnord Corporation.

Mr. Stropki's experience as a president and chief executive officer of a publicly-traded corporation allows him to make significant contributions to our Board of Directors. His 40 years of experience at Lincoln Electric have provided him with vast management, manufacturing and leadership skills in an industrial company as well as important perspectives on operating a business in a global market. | | 2013 |

| Britton T. Taplin | | 62 | | Self-employed (personal investments) from prior to 2014. Mr. Taplin also serves as a Director of NACCO.

Mr. Taplin is the grandson of the founder of NACCO and brings the perspective of a long-term stockholder to our Board of Directors. | | 2012 |

| Eugene Wong | | 84 | | Professor Emeritus of the University of California at Berkeley. Dr. Wong has broad experience in engineering, particularly in the areas of electrical engineering and software design, which are of significant value to the oversight of our information technology infrastructure, product development and general engineering. He has served as technical consultant to a number of leading and developing nations, which enables him to provide an up-to-date international perspective to our Board of Directors. Dr. Wong has also co-founded and managed several corporations, and has served as a chief executive officer of one, enabling him to contribute an administrative and management perspective of a corporate chief executive officer. | | 2012 |

| | | | | | | | | | | | | | | | | | | | |

| Name | | Age | | Principal Occupation and Business Experience During Last Five Years and other Directorships in Public Companies | | Director Since |

| Claiborne R. Rankin | | 71 | | Manager of NCAF Management, LLC, the managing member of North Coast Angel Fund, LLC (a private firm specializing in venture capital and investments) from prior to 2017. Managing Member of Sycamore Partners, LLC, the manager of NCAF Management II, LLC and managing member of North Coast Angel Fund II, LLC (each a private firm specializing in venture capital and investments) from prior to 2017. Mr. C. Rankin also serves as Chairman of the Board of TPA Stream Inc. Mr. C. Rankin also is a Director of the Angel Capital Association since May 2020 to present.

Mr. C. Rankin is the grandson of the founder of NACCO. As a member of the board of HYG for more than 20 years, Mr. C. Rankin has extensive knowledge of the lift truck industry and the Company. This experience and knowledge, his venture capital experience and the perspective of a long-term stockholder enable him to contribute to our Board of Directors. | | 2012 |

| Britton T. Taplin | | 65 | | Self-employed (personal investments). From prior to 2017 to present, Mr. Taplin serves as a Director of NACCO. From September 2017 to present, Mr. Taplin serves as a Director of HBB.

Mr. Taplin is the grandson of the founder of NACCO and brings the perspective of a long-term stockholder to our Board of Directors. | | 2012 |

| David B.H. Williams | | 52 | | President and Partner of the law firm Williams, Bax & Saltzman, P.C. from prior to 2017.

Mr. Williams is a lawyer with more than 25 years of experience providing legal counsel to businesses in connection with litigation and commercial matters. Mr. Williams' substantial experience as a litigator and commercial advisor enables him to provide valuable insight on business and legal issues pertinent to the Company. | | 2020 |

| Eugene Wong | | 87 | | Professor Emeritus of the University of California at Berkeley from prior to 2017.

Dr. Wong has broad experience in engineering, particularly in the areas of electrical engineering and software design, which are of significant value to the oversight of our information technology infrastructure, product development and general engineering. He has served as technical consultant to a number of leading and developing nations, which enables him to provide an up-to-date international perspective to our Board of Directors. Dr. Wong has also co-founded and managed several corporations, and has served as a chief executive officer of one, enabling him to contribute an administrative and management perspective of a corporate chief executive officer. | | 2012 |

J.C. Butler, Jr. is the son-in-law of Alfred M. Rankin, Jr. Asand, as indicated on the Director Compensation Table shown below, in 20182021 Mr. Butler received $203,624$225,201 in total compensation from us as a director.

David B.H. Williams is the son-in-law of Alfred M. Rankin, Jr. and, as indicated on the Director Compensation Table shown below, in 2021 Mr. Williams received $205,447 in total compensation from us as a director.

Claiborne R. Rankin is the brother of Alfred M. Rankin, Jr. Asand, as indicated on the Director Compensation Table shown below, in 20182021 Mr. C. Rankin received $195,109$206,342 in total compensation from us as a director.

The following table sets forth all compensation of each director,the directors, other than Alfred M. Rankin, Jr. ("Mr. A. Rankin"),Rankin, for services as our directors and as directors of certain of our operating subsidiaries. In addition to being a director, Mr. A. Rankin serves as Chairman President and CEO of the Company and Chairman of HYG. Mr. A. Rankin does not receive any compensation for his services as a director. Mr. A. Rankin's compensation for services as one of our Named Executive Officers is shown in the Summary Compensation Table on page 34.30.

For Fiscal Year Ended

2021 Director Compensation

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Earned or Paid in

Cash

($)(1)(2) | | Stock

Awards

($)(1)(3) | | All Other

Compensation

($)(4) | | Total

($) |

| James B. Bemowski | | $93,166 | | $117,860 | | $7,395 | | $218,421 |

| J.C. Butler, Jr. | | $101,166 | | $117,860 | | $6,175 | | $225,201 |

| Carolyn Corvi | | $137,166 | | $117,860 | | $7,368 | | $262,394 |

| Edward T. Eliopoulos | | $102,188 | | $117,860 | | $2,395 | | $222,443 |

| John P. Jumper | | $122,606 | | $117,860 | | $6,066 | | $246,532 |

| Dennis W. LaBarre | | $145,166 | | $117,860 | | $6,078 | | $269,104 |

| H. Vincent Poor | | $94,166 | | $117,860 | | $7,320 | | $219,346 |

| Claiborne R. Rankin | | $81,166 | | $117,860 | | $7,316 | | $206,342 |

| Britton T. Taplin | | $81,166 | | $117,860 | | $7,395 | | $206,421 |

| David B.H. Williams | | $80,166 | | $117,860 | | $7,421 | | $205,447 |

| Eugene Wong | | $22,274 | | $186,589 | | $4,248 | | $213,111 |

(1)Effective for meetings after May 1, 2020, the Board of Directors agreed to a 10% reduction in the annual retainer and all committee fees payable to directors in conjunction with various global cost containment measures taken by the Company due to the adverse impact of the COVID-19 pandemic on the Company's business. The 10% COVID-19-related reduction to the annual retainer and all committee fees payable to the directors ceased effective January 1, 2021. Effective July 1, 2021, the Board of Directors approved a Korn Ferry-recommended increase in the Board retainer for the remainder of 2021. The amounts shown in the Director Compensation table above reflect the amounts actually received by each director for 2021.